UPDATED: UNILORIN FEMALE UNDERGRADUATE COMMITS SUICIDE OVER HARASSMENT FROM LOAN APPS

By Adeola Abdullah

A female undergraduate of the University of Ilorin, Ilorin, Kwara State; on Monday morning took her own life.

Hameedah, aged 20, was said to have taken the decision to end it all over continous harassment from several online loan apps that she has outstanding debts with.

Checks from fellow undergraduates who knew Hameedah revealed that she had threatened to commit suicide since last week when operators of the loan apps resorted to sending demeaning text messages to her, her friends and relations, and also her parents.

A source disclosed to Hotjist that the late undergraduate got into a heated exchange with her parents over the matter. The 300level Microbiology undergraduate was said to first been enmeshed in debt around April 2023 when she was said to have outstanding loans from the apps in the region of N270,000. At that point, her parents and siblings had got involved with the siblings offsetting her indebtedness even without the knowledge of her parents.

Hameedah reportedly told her dad then, that she had borrowed the money to stake in online sport betting apps but she lost all the money.

Recently again, it was discovered that Late Hameedah could not account for a sum of money said to be over N400,000 kept in her care by her mother. Hameedah had alleged that she lent out the money to a friend whose mother is being treated for cancer at the Obafemi Awolowo University Teaching Hospital, Ile-Ife, Osun State.

Upon the assertion, her family were said to have asked Hameedah for the identity of the borrower, a request to which she replied that she had lost contact with the borrower who had since disappeared into thin air.

On Sunday, her siblings were said to asked her to produce the transaction receipt by which she used to transfer money to the borrower, a request she hadn’t responded to favourably until the time of her death.

It was learnt that also on Sunday, Hameedah intimated some of her friends that she had bought Sniper, a strong pesticide used for agricultural purposes, to take her own life, a threat she had initially made to her parents.

Her friends were said to have tried to convince her not to take that line of action. However, in the early hours of Monday, her roommates discovered her to be writhing in pain, in her bed, within one of the hostel facilities on the campus of the University.

It was learnt that the hostel porter along with others quickly mobilised to get urgent medical attention for her but was pronounced ‘Brought In Dead’ on getting to the University of Ilorin Teaching Hospital (UITH).

Hameedah’s parents were to said to have been promptly notified of the tragic incident.

Friends who wish to remain anonymous said the loan exposure of the late undergraduate to the several loan apps is in the region of N500,000 ($635). She was believed to have engaged in online affiliate marketing, some of which went south leading her to source loans from different platforms to meet her loan obligations.

Some of the loan apps mentioned include MS Info, NCredit, 9jaCash, NewedgeNews (New Credit), ECash, NowNowMoney, My N and a host of others.

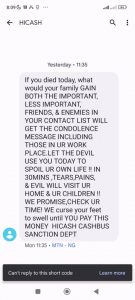

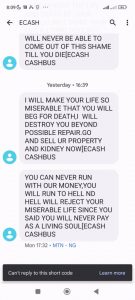

Hotjist got hold of some of the threat messages allegedly sent by some of the loan apps.

Recall that the the Federal Competition and Consumer Protection Commission (FCCPC) had delisted several Digital Money Lenders (DMLs) for operating without regulatory approval.

Babatunde Irukera, the Executive Vice Chairman of FCCPC said the commission would continue to engage Google to clarify how and why apps that had not received relevant regulatory approvals were available on its platform (Play store).

”DMLs are reminded that infractions or infringements may lead to permanent delisting and prohibition, as well as law enforcement action, including prosecution,” he said.

Irukera reiterated the commission’s commitment to ensuring legal and ethical operations in digital money lending.

He called on consumers to patronise only approved DMLs.