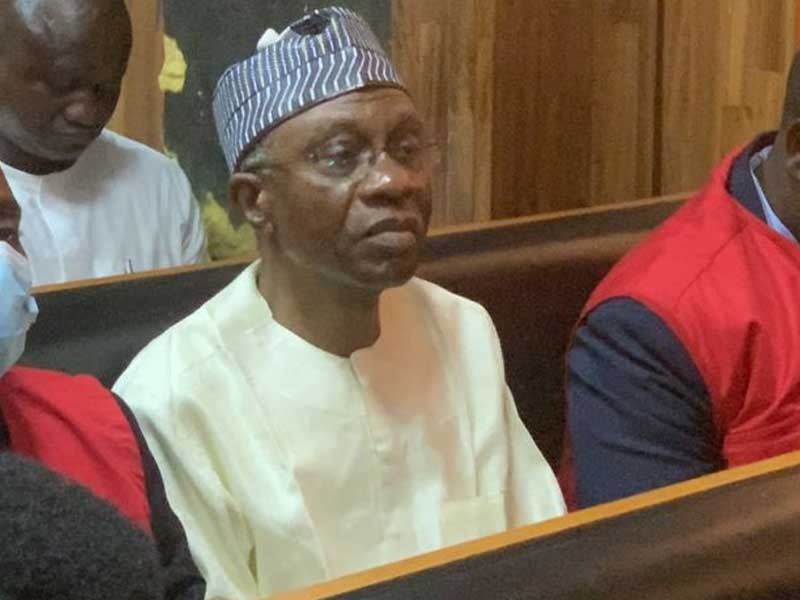

NO EVIDENCE TIES EMEFIELE TO ZENITH BANK ACCOUNTS, EFCC WITNESS ADMITS IN COURT

A prosecution witness in the ongoing trial of former Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, has told the court that there is no document directly linking him or his wife, Margaret, to bank accounts held by several companies allegedly connected to him.

The witness, a compliance officer with Zenith Bank Plc, gave the testimony before Justice Yusuf Halilu of the Federal High Court, Abuja, during Friday’s proceedings in the case filed by the Economic and Financial Crimes Commission (EFCC) against Emefiele.

The EFCC is prosecuting the former apex bank chief over alleged abuse of office and property fraud involving billions of naira and a 753-unit housing estate in the Federal Capital Territory (FCT).

During cross-examination by Emefiele’s lead counsel, Matthew Burkaa (SAN), the witness admitted that after reviewing account-opening documents and records of companies allegedly linked to Emefiele — including MG Properties Limited, Ifedigo Integrated Services, Kelvito Integrated Services, Limelight Multidimensional Ltd, Comec Support Services Ltd, and Ambswin Resources Ltd — there was no evidence that Emefiele or his wife were signatories, shareholders, or beneficial owners of any of the accounts.

He further explained that he had signed a certificate of compliance dated May 29, 2024, but was not aware it would be used as evidence in court and had never made any formal statement to the EFCC. The compliance officer also confirmed that Emefiele’s name did not appear in any of the account-opening forms or internal bank mandates of the companies, and that there were no internal resolutions or records indicating that either he or his wife had control over the accounts.

The prosecution alleges that Emefiele, alongside his co-defendant Eric Ocheme (who is currently at large), acquired and controlled a 753-unit housing estate located at Plot 109, Cadastral Zone C09, Lokogoma District, Abuja, covering 150,462.86 square meters. The EFCC also claims that several large transactions — amounting to ₦167 million, ₦1.23 billion, ₦900 million, and ₦600 million — were channelled through Zenith Bank accounts operated by the said companies.

However, the defence team insists that the prosecution has failed to establish any direct link between Emefiele and the bank accounts, arguing that the charges are based on assumptions rather than verifiable evidence.

Burkaa, SAN, has also filed a preliminary objection challenging the court’s jurisdiction and asking that the charges be dismissed. But the prosecution counsel, Rotimi Oyedepo (SAN), opposed the motion and urged the court to proceed with the trial, maintaining that the EFCC would prove its case through documentary and circumstantial evidence.

After hearing both sides, Justice Halilu adjourned the case to November 26, 2025, to allow for the filing of written submissions on the jurisdictional issue and the continuation of witness testimony.

Legal analysts say the testimony marks a major twist in the high-profile case, as the EFCC’s inability to directly link Emefiele to the Zenith Bank accounts may weaken part of its case. However, they note that the anti-graft agency could still rely on financial tracing, corporate ownership records, and expert analysis to strengthen its argument.

The case remains one of the most closely watched corruption trials in Nigeria, drawing significant public attention due to Emefiele’s former position as the head of the nation’s apex bank.