FAAC: FG, STATES, LGAs SHARE N1.681 TRILLION IN APRIL

By: Sefiu Ajape

The Federation Account Allocation Committee (FAAC) has disbursed a total of N1.681 trillion as revenue generated in April 2025 to the Federal Government, 36 States, and 774 Local Government Councils across Nigeria.

This was revealed during the FAAC meeting held on Friday in Abuja, with the figure showing an increase of N103 billion from the N1.578 trillion shared in March 2025.

According to the communiqué issued after the meeting, the total distributable revenue for April comprised N962.882 billion in statutory revenue, N598.077 billion from Value Added Tax (VAT), N38.862 billion from the Electronic Money Transfer Levy (EMTL), and N81.407 billion from Exchange Difference.

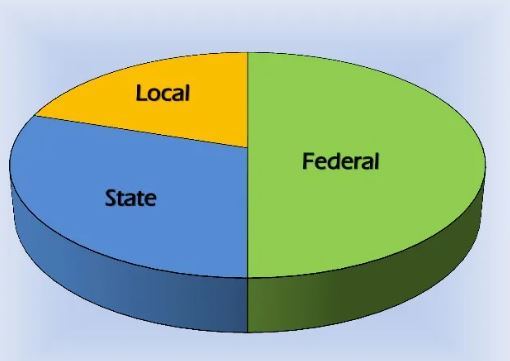

From the total allocation, the Federal Government received N565.307 billion, the State Governments got N556.741 billion, while Local Government Councils were allocated N406.627 billion. An additional N152.553 billion was shared among oil-producing states as 13% derivation from mineral revenue.

FAAC also noted that the gross revenue available in April stood at N2.848 trillion.

However, deductions were made amounting to N101.051 billion for the cost of revenue collection and N1.066 trillion for statutory transfers, refunds, interventions, and savings.

The communiqué disclosed that the gross statutory revenue for April stood at N2.084 trillion, which represents an increase of N365.595 billion over the N1.718 trillion recorded in March.

In the same vein, gross VAT revenue rose slightly to N642.265 billion in April, compared to N637.618 billion in the preceding month, reflecting a growth of N4.647 billion.

A breakdown of the N962.882 billion distributable statutory revenue showed the Federal Government receiving N431.307 billion, States N218.765 billion, and Local Government Councils N168.659 billion.

From this amount, N144.151 billion was shared as 13 percent derivation to oil-producing states.

In terms of VAT, the Federal Government got N89.712 billion, the States received N299.039 billion, and the Local Government Councils received N209.327 billion from the N598.077 billion pool.

Revenue from the Electronic Money Transfer Levy (EMTL), which totaled N38.862 billion, was distributed with the Federal Government receiving N5.829 billion, States N19.431 billion, and Local Governments N13.602 billion. Also, from the N81.407 billion realised as Exchange Difference, the Federal Government received N38.459 billion, the States N19.507 billion, and Local Government Councils N15.039 billion.

In addition, N8.402 billion from this category was shared as 13 percent derivation to eligible states.

FAAC further revealed that there were significant increases in revenue from Petroleum Profit Tax (PPT), Oil and Gas Royalties, VAT, EMTL, Excise Duty, Import Duty, and CET Levies during the period under review.

However, revenue from Companies Income Tax (CIT) recorded a considerable decline.

The April 2025 revenue performance reflects continued volatility in the federation’s income sources, even as government efforts to improve non-oil revenue generation appear to be yielding positive results.