HOW UBA HELPED FRAUDSTERS DRAIN N2 MILLION FROM CUSTOMER’S ACCOUNT

By Adeniyi Onaara

The life of a woman is on the line. The United Bank for Africa, Africa’s self-proclaimed largest bank, has a weak security system. UBA.

The woman, Olori Adenike Babalola Okekporo, was a victim of internet fraud on Tuesday, May 24, when her bank account was drained of N2 million naira, leaving only N700 in the account.

Attempts to have the bank restore the funds were unsuccessful because the lapse occurred on their end and she did not make the withdrawals, forcing Okekporo to publicly express her dissatisfaction.

According to the lady, the majority of the funds were fraudulently removed while she was on the phone with the bank’s customer service department.

“Finally, @UBAGroup has aided in the draining of my account by scammers and hackers.” While reporting suspicious activity on my account to their phone center, 2 million naira gone in minutes.

“After receiving the first N500,000 notice from @cenbank, I immediately called the bank” (Central Bank of Nigeria).

” The second alert of another N500,000 came while the customer service guy was still asking me foolish questions, and so on.

“These folks have screwed with my mind.” My account has just been emptied of N2.1 million naira. You’ll be the first to kill me, UBA. I can’t remember the last time I sobbed that hard. She moaned, “I feel so helpless.”

“Because I do not have an ATM card for the said account, UBA, please explain why you have refused to transfer my monies since I wrote to you in February.”

“How did they manage to withdraw more money than the daily limit?” she questioned.

Apart from the 2 million naira, Okekporo alleged that the bank had previously refused to release money that her university had repaid her.

“All because I was pleading with @UBAGroup and @UBACares to release the funds my university had given me.” Tell @UBAGroup to reimburse my money, @cenbank.

“Every student in the UK and @cenbank should assist me beg @UBAGroup to give me my £1050 that my university has refunded since November 2021,” says one Nigerian. I’m now stranded and need to pay my bills.

“If you see me sleeping on the street beneath a duvet, it’s because UBA Group and the Central Bank of Nigeria did it to me since my landlord won’t listen to my stories.”

Furthermore, @UBACares has ceased replying to my emails. Since 2021, my £1050 has been in that bank. Since February 2022, I’ve demanded that it be transferred. “I haven’t received it yet.”

I’ve been requesting a move since February 23rd, 2022. On April 4th, after filling out a variety of documents, I was forced to undergo video verification on WhatsApp. My problem would be resolved in 48 hours, according to the officer.

“I recharged my Nigerian line last Thursday so I could phone their customer service because the same CFC has refused to react to my email, and I still haven’t received my money.” The date is May 21, 2022. On April 4th, I performed video verification.

“This deception was perpetrated when I was on call with them.”

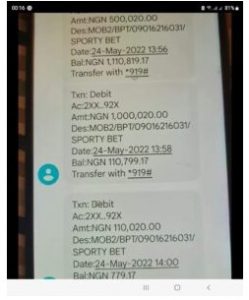

A screenshot of the N2 million debt is seen below.

After being called out on social media, the bank contacted Okekporo.

“Greetings, @OloriAdenike13, Thank you for getting in touch with Africa’s Global Bank, UBA. To assist you, please supply your mobile number, account number, email address, and the date of the disputed transaction. We apologize for any inconvenience this may have caused. “I appreciate it.”

After the fraudulent activities, the bank eventually frozen the account and disabled her debit card to protect the account.

Despite the fact that she had previously specified that she did not have a debit card for that account, the bank notified her that she would need to get a new debt card for N1,075.

However, until this article was published, UBA had not to recover her stolen funds or complete the £1050 transfer from her UK school.

However, a few concerned people have discreetly approached her to donate their widows mite.

As some of her social media followers who shared their own bitter pill experiences with the bank testified, this incident is simply one of many fraudulent actions being carried out on UBA clients’ accounts.